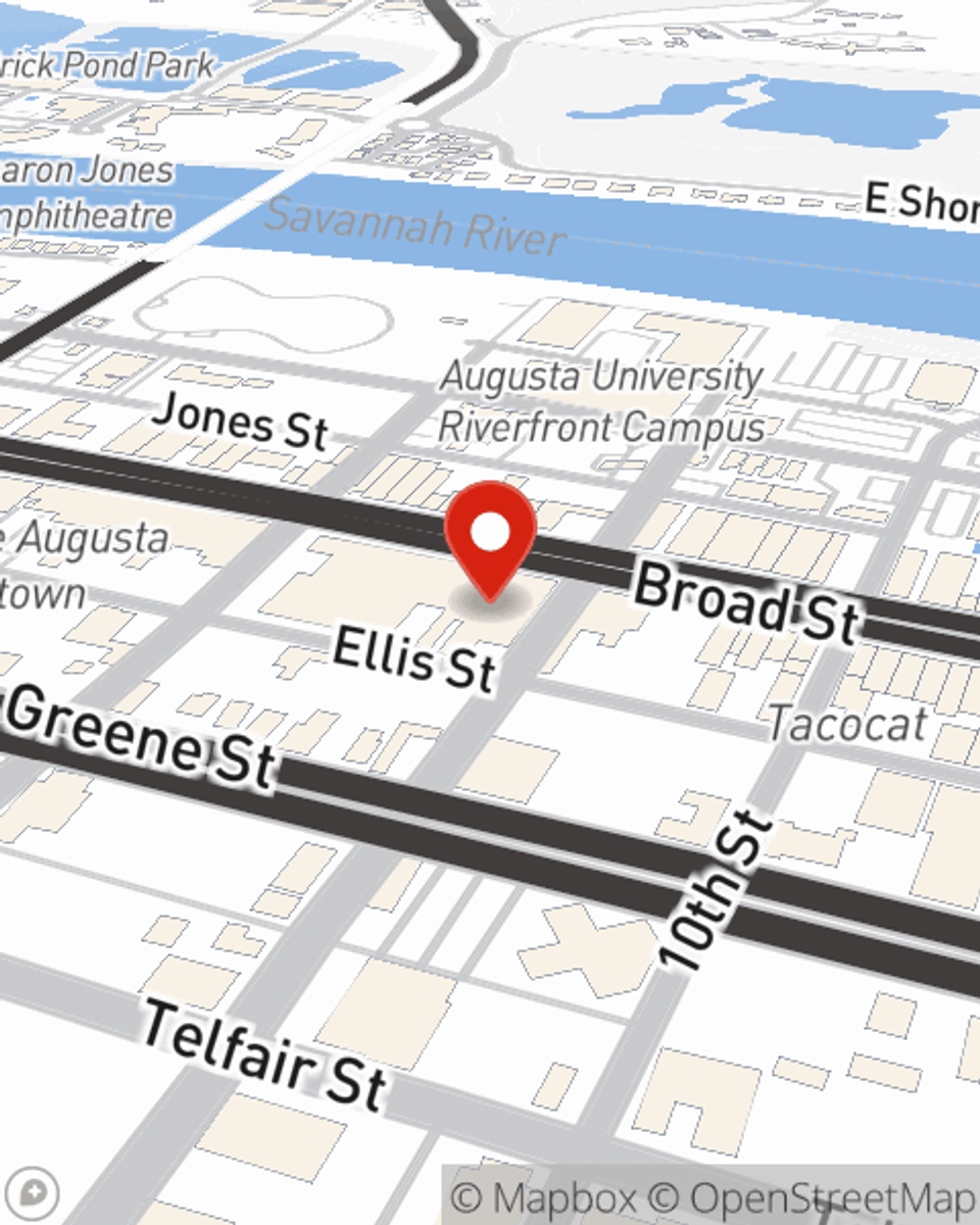

Business Insurance in and around Augusta

Augusta! Look no further for small business insurance.

This small business insurance is not risky

- Atlanta

- Augusta

- Savannah

- Greenville

- Charleston

- Columbia

- Miami

- Orlando

- Tampa

- Jacksonville

- Charlotte

- Raleigh

- Greensboro

- Nashville

- Memphis

- Knoxville

Coverage With State Farm Can Help Your Small Business.

Operating your small business takes time, commitment, and outstanding insurance. That's why State Farm offers coverage options like extra liability coverage, business continuity plans, errors and omissions liability, and more!

Augusta! Look no further for small business insurance.

This small business insurance is not risky

Surprisingly Great Insurance

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Mike Ingham for a policy that safeguards your business. Your coverage can include everything from errors and omissions liability or business continuity plans to key employee insurance or mobile property insurance.

Agent Mike Ingham is here to talk through your business insurance options with you. Reach out Mike Ingham today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Mike Ingham

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.